Kai Pfaffenbach | Reuters

Check out the companies making headlines in midday trading.

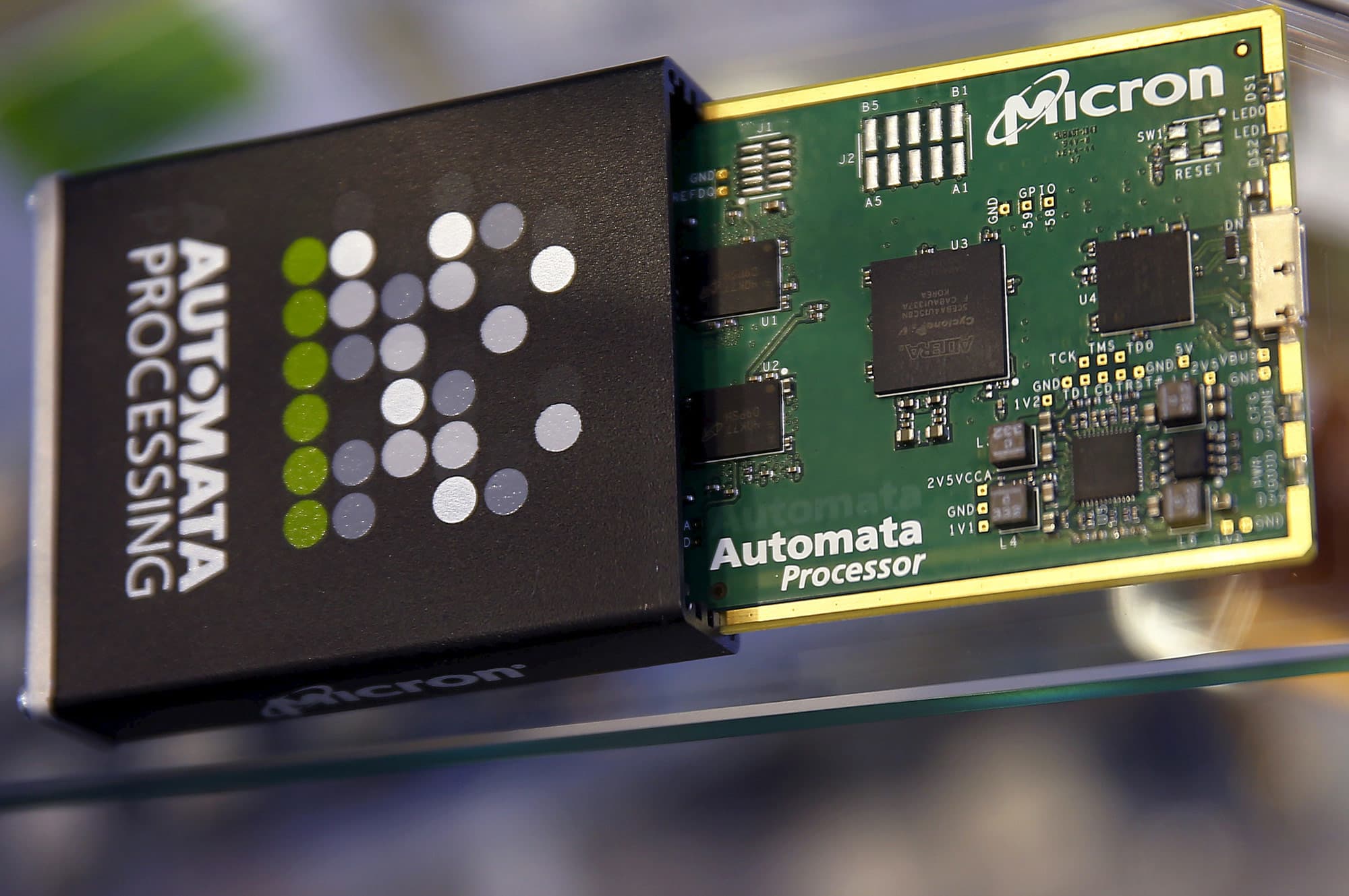

Micron — Micron shares popped more than 6% after a Citi analyst upgraded the chipmaker to buy from sell, citing a favorable supply-and-demand outlook.

Alibaba — Shares of the Chinese e-commerce giant jumped more than 4% after CNBC’s David Faber reported billionaire founder Jack Ma is not missing and he’s just laying low for the time being. There had been speculations about Ma’s disappearance after his Ant Group saw its record-setting IPO suspended by stock exchanges in Shanghai and Hong Kong. Ma was last seen at a public event in October.

JD.com — Shares of the Chinese e-commerce giant rose more than 9% after a Stifel analyst upgraded them to buy from hold. “JD.com remains one of the leading eCommerce platforms in China with a number of secular growth trends to support healthy long-term growth and ongoing margin expansion,” the analyst said.

China Telecom, China Mobile, China Unicom — Shares of the three Chinese telecom giants popped after the New York Stock Exchange said it no longer plans to delist the stocks from their exchange. Shares of China Telecom and China Mobile rose more than 9% each. Shares of China Unicom rallied more than 14%.

Diamondback Energy, Exxon Mobil, Chevron — Shares of the oil and energy giants rose on Tuesday after U.S. West Texas Intermediate crude futures, the U.S. oil benchmark, broke above $50 for the first time since February. Shares of Diamondback Energy surged 10%. Exxon Mobil and Chevron rose 5% and 3%, respectively.

First Solar — Shares of the solar company tanked more than 9% after Goldman Sachs downgraded the stock to sell from buy. The Wall Street firm said earnings and revenue have already peaked for this cycle.

Roku — Shares of Roku gained nearly 4% after Wells Fargo hiked its price target on the streaming media company to a Street high of $414 from $275. The bank said there is a big runway for Roku’s growth amid a push into monetizable video-on-demand content. The new price target would translate into a 25% rally in the next 12 months.

Uber — Shares of the ride hailing giant popped nearly 3% after Needham named Uber a top pick. The Wall Street firm said the Covid-19 recovery is not fully priced into Uber’s stock.

Papa John’s International — Shares of the pizza chain gained 2.7% after investment firm Longbow named the stock a top pick. The firm said in a note to clients that it is bullish on new products in the company’s pipelines and internal improvement implemented by the relatively new management team.

Coca-Cola — The beverage stock slipped just under 1% after Guggenheim downgraded Coca-Cola to neutral from buy. The investment firm said in a note to clients that the company is going through a “transition” year and its shares are fairly priced.

— with reporting from CNBC’s Yun Li, Jesse Pound and Pippa Stevens.