When French telecommunications company Altice acquired U.S. cable companies Cablevision and Suddenlink, Chairman Patrick Drahi made a bold statement: Altice USA would rival Comcast and Charter in size, becoming one of the three dominant U.S. cable operators.

Fast forward nearly six years, and Altice USA has about 5 million customer relationships, compared with about 31 million each for Comcast and Charter. (Altice USA did announce a $310 million acquisition of Morris Broadband on Monday, which will give it about 36,000 more customers.)

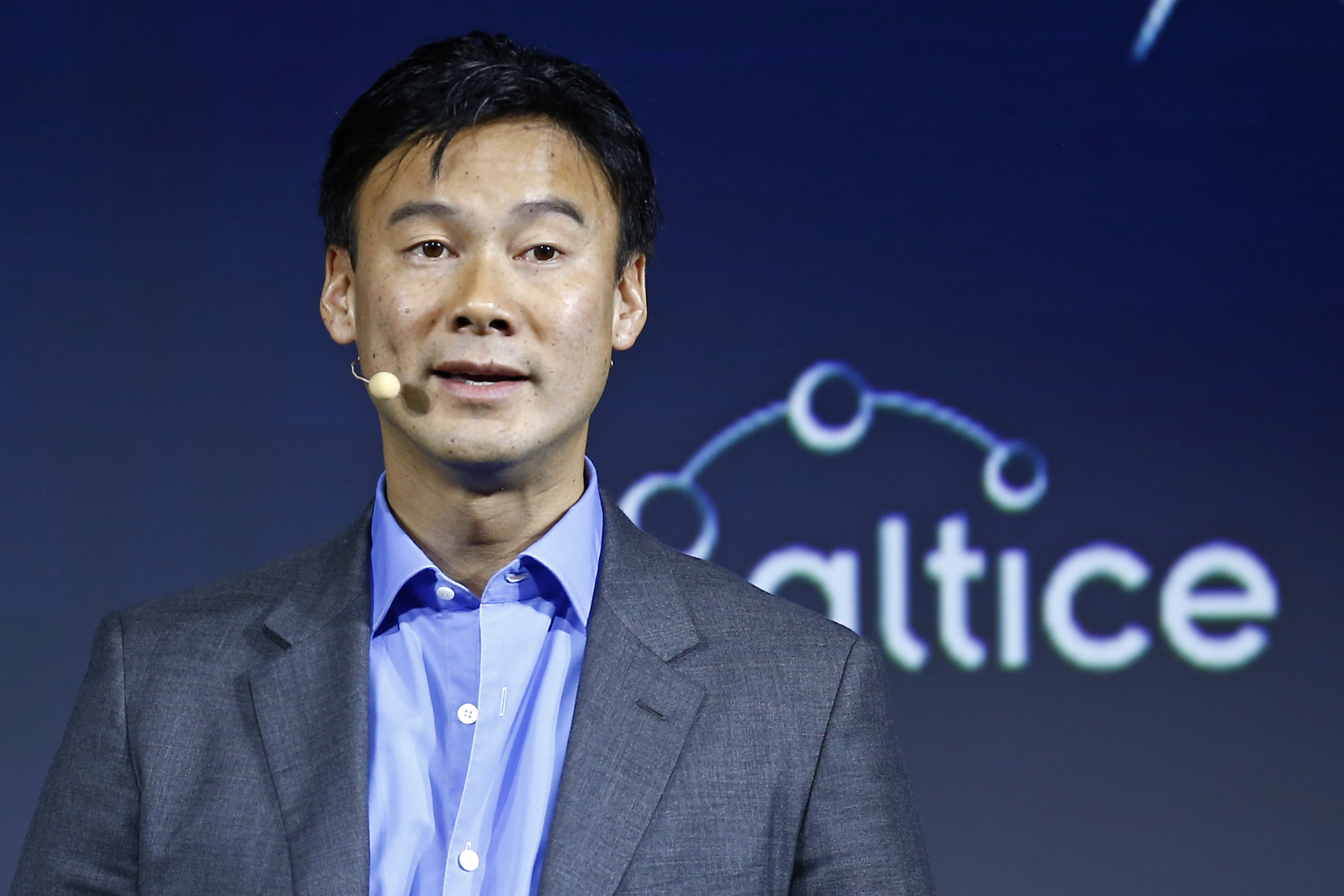

CEO Dexter Goei explained to CNBC what prevented Altice USA’s rapid expansion, why he thinks cable and wireless will eventually merge in the U.S., and why it’s only a matter of time before cable TV becomes extinct.

*****

(This interview has been lightly edited for length and clarity.)

Alex Sherman, CNBC: It’s been more than five years since Altice completed its deal to buy two US cable companies: Suddenlink and Cablevision. Altice’s Chairman, Patrick Drahi, said at the time, “The two leaders, Comcast and Charter, will not be able to buy anything because of their size. So we will have an open boulevard ahead of us. If I buy if I buy five small operators, I can be as big as Time Warner Cable,” which, of course, doesn’t exist anymore. How many customer relationships do you guys have now?

Dexter Goei, Altice USA CEO: We have just about five million.

About five million. So you’re not as big as Time Warner Cable, which had about 12 million at the time. And I’m not sure that that comment about Charter and Comcast not being able to buy anything else is still correct. What happened between then and now? Did anything surprise you in the landscape that made Patrick’s comments seem a little bit out in front of his skis?

The reality is there’s been nobody selling, nobody of size — of any credible size. And so with all the goodwill that we have and the expertise and the things that we think we can do — probably slightly better than some of our peers in acquiring businesses — we haven’t had the opportunity to show our stripes again of anything of meaningful size. The biggest transaction was something that that Cable One just acquired for a couple of billion. And that was very specific to to certain regions that we’re not in.

Why did that stop? Because at the time it seemed like everyone was selling. Charter bought Bright House and Time Warner Cable and you guys bought Suddenlink and Cablevision, all within a couple years. And it just seemed like there was this machine toward consolidation and then seemingly everything stopped. Why did that happen?

I don’t know, other than what’s clear is most of the existing current owners of other assets out there that are not ourselves, Charter and Comcast, including Cox, by the way, are owned by families that have been in the cable business pretty much since the 70s, when cable franchises were being allocated and cable networks were being built.

And that’s pretty much across the U.S. People have been owners for 10, 20, 30 years, more. And if you speak to a lot of these people they all say the same thing, which is, one, we like the business. Number two is we understand it’s created a lot of value, and we don’t need the money. And so we’re just going to continue to do what we do. And I think they very much like being pioneers in their respective communities. Your cable operator, particularly some of the smaller cable operators, are really big mainstays of the business community. And so all of that makes sense if you really don’t need the money and don’t know what to do with the money. These businesses are generating a tremendous amount of free cash flow. And so, yes, you could probably sell at five billion. But if you’re getting whatever, you know, three or four hundred million of dividends every year, it’s not like it’s not like there’s anything else to do.

Did you not know that five years ago? The owners are the same.

We were able to unlock [Cablevision founder] Chuck Dolan. That was the asset that everyone had been trying to unlock for a very long time. And Time Warner was for sale, and we believe that if we had already cleared regulatory in the US, we would have won that asset, and then we bought Suddenlink. So we saw three sizable assets — one mega asset and two other smaller ones — come to market. So our belief was if everyone is selling, then we would see a follow through of a lot more families selling. But it all stopped. It literally just stopped there.

So what now? What’s the path forward now? Because you made an offer to buy Atlantic Broadband out of Cogeco, and that was rejected. Along the theme you just described, it seemed like they were not all that interested. What’s the path forward?

The path forward is very simple, which is we’re focused on our organic operations. We are very focused on building out our footprint, more upgrading on fiber to the home, which we find to be a fantastic opportunity to drive revenues and stickiness among our customers, and we’ll look for smaller M&A to the extent that there’s not larger M&A available. In the absence of that, all of our free cash flow goes back to buying back our shares because we continue to trade at close to a 10% free cash flow yield when our debt complex trades in the 3s. So we’ve got kind of a six to seven hundred basis points difference between our cost of equity and our cost of debt. And so we’ll continue to retire and invest in our shares to the extent that we can’t buy other things. Cable aside, we’ve looked at wireless businesses as well. We’ve looked at ad tech businesses as well. So we’ll continue to look at accretive things. The best use of our capital always is M&A, but we have to find things that are interesting to buy.

Let’s talk about wireless. In Europe, Altice and other companies own both wireless and cable assets. While we’ve seen cable companies get into wireless using spectrum sharing agreements in this country —- you do this with Altice Mobile that uses what’s now T-Mobile’s network, used to be Sprint — we haven’t seen a merger between a cable company and a wireless company in the U.S. Is that where we’re ultimately heading?

I have been saying that for the last couple of years. It just doesn’t make any sense not to, purely from an operational synergies, from a capital allocation synergies, from a branding synergies standpoint, and clients ultimately — when they do have more and more services from the same provider — the stickiness is better. It does have real churn benefits. That’s the reason why cable has gone into into the mobile business.

But we all collectively have gone into a mobile business, which maybe has good churn benefits, but economically is not that attractive. Renting someone else’s network fundamentally always is going to be reduced economics relative to owning and operating your own network. And so if it doesn’t happen this year, that is clearly something that we expect to go forward.

Now, AT&T is focused on building out more fiber. Verizon is building out more fiber even for just their 5G aspirations. And then T-Mobile has as a great mid-band strategy on 5G that it would make sense for them to be probably a good partner for one of the large cable operators.

From a regulatory standpoint, do you feel like the United States is in the environment where one of those deals can get done? Does it have to be T-Mobile because they’re the smallest of the three? Can you imagine a world where Comcast and Verizon would be allowed to merge?

Never say never, right? I think the last four years have taught us to no longer be in the M&A prediction business. So I’m not in the prediction business.

But what I can say is that strategic transactions where you have different services, I don’t understand why that should not be something that should be allowed by the antitrust division. Obviously, you know, the Fios element of Verizon could be very problematic from an antitrust standpoint for Comcast in certain of its areas. But I’m sure there are there are buyers for that asset — including ourselves, by the way, and probably Charter and other people.

I do believe that consolidation among fixed and wireless makes a lot of sense. There’s consolidation in every other developed country in the world already, right? So it just doesn’t make sense that we’re the exception.

So outside of that, if you just took Verizon wireless and Comcast fixed, I don’t know why that could not be something that the regulators would view as attractive. It could really drive better performance for consumers and better pricing.

One of the limitations on doing a wireless deal for Altice USA is you only have five million customer relationships. You’re not a national player.

So, we like wireless in itself, and we think we’re good wireless operators of infrastructure, but if we acquired a national wireless provider, that would be a separate investment thesis then trying to do a quad play with Altice USA.

We clearly would have some synergies, but the thesis of acquiring a mobile or trying to merge with mobile would be really based on the fact that we think we could do something better with the mobile business going forward.

OK, Got it. So it would be parent Altice that would be the acquirer.

Yeah. And maybe it’s a stepping stone for greater consolidation, whether it’s a T-Mobile, or it’s a Verizon and AT&T with a fixed-line operator, so that we have more of a national footprint because one of our friends over at Comcast or Charter would like to be part of that equation as well.

You don’t know how the chess pieces are eventually ever going to settle. But I do believe that consolidation among fixed and wireless makes a lot of sense. There’s consolidation in every other developed country in the world already, right? So it just doesn’t make sense that we’re the exception.

For those that aren’t as familiar with cable operations, can you explain what Altice’s strategy has been within your cable footprint? I know you’ve spent a lot of money building out fiber, or at least a hybrid network, which effectively replaces traditional cable. Why is this a good investment for the company?

There is a regular — every two or three years — upgrade cycle of the DOCSIS (Data Over Cable Service Interface Specification) HFC (hybrid fiber-coaxial) network, whether it’s on the DOCSIS software or it’s on the actual network itself. This is done by dropping fiber deeper and by splitting the nodes. That is an ongoing, everlasting cycle. Everyone’s waiting for the next upgrade cycle to be able to go faster than 1 GB or to get symmetric speeds on upload and download. You can’t today on cable.

And we have been rolling out in our sister company throughout Europe — France, Portugal, Israel — fiber to the home everywhere, because ultimately that is the best technology that’s out there in fixed line. It does provide the best upload and download speeds. It does have the best response rates. It has all of the physical and engineering traits that you would want for cable today, which you don’t have in the U.S. because it’s not fiber to the home.

Cable companies are often very much maligned among the consumer base. On the video side, prices continue to rise as content [prices rise], and so we have to pass through that, but we are the bad guy because people don’t really understand that the MSNBCs of the world and other channels are out there pushing prices.

Wait a second, don’t be blaming CNBC for your reputation here, please.

Ha, OK.

But at the end of the day, people are calling in not only for their bill issues, but they’re also calling in because there are problems with the network, whether it’s weather-related, whether it’s usage-related, because the neighborhood all of a sudden has gotten very contentious and congested.

Whatever it is, the cable network is just not as good. And so, one of the big cost elements in the cable network is the amount of servicing that’s required every time you call. You call to a call center when you’ve got a problem with the technical side, you get a service person to come in and repair it. Sometimes a service person has to come two or three times to come repair it. And additionally, the maintenance of that network is expensive on the cable side.

So why not build out a brand new network that provides speeds today that can go up to 10 gigs up and down, that has less service-related technical issues? So you’ll have less people calling into the service center, less times having people coming with muddy boots into your house, and on top of that, save a lot of capital expenditure going forward on maintenance.

So that equation made the the financial investment ROI very attractive. We’ve got about 20% of our Optimum footprint (from Cablevision) that’s already fiber to the home. We know that we can sell fiber to the home better than cable. It’s a more attractive product. We can go to much higher speeds, a lot quicker — much more than one gig over HFC and DOCSIS. So fiber to the home is the technology. It’s the best technology. And I think we’ll be proven very right relative to the customer response — not only in terms of the product but to reduce our investment cycle going forward. You know, if you never had to call your cable company, you’d probably would love your cable company. We think it’s going to really help on all of those fronts.

As you continue to upgrade the network, is there a trading multiple on pure-play cable companies you have in mind that you that you see as reasonable or fair so that you can properly judge all of these cable companies against each other? Because right now they’re a little all over the map.

I think it’s really driven by penetration levels. So obviously, lower penetration allows you to have a lot more upside. The competitive landscape of who you’re competing against is meaningful. We compete in a big chunk of our footprint against Fios, which is a formidable competitor in itself, whereas a lot of operators have don’t have Fios-like competitors across the board.

But by and large, you do believe that 90%-plus of your footprint is going to have a broadband connection. Today, they have a broadband connection that is maybe 60-70% penetrated with a fast broadband, 100 megabits-plus, and then you have the remainder 20% or 30% which is DSL or has never had a broadband connection there.

Given what we know and the appetite by consumers to continue to consume data bits heavily, this is something that’s going to continue. Penetration levels are going to get higher and higher, which means that if the whole country is growing with household formation, there’s going to be more and more broadband subscribers overall in the population. And then furthermore, people are upgrading regularly to higher and higher speeds. Don’t tell me you didn’t upgrade your speed since since you’ve been in the pandemic. I’m certain you somewhere in one of your households or in one of your family members, you guys have upgraded your speeds.

And so that’s going to continue. You are going to require better and better connectivity. You’re going to require your upload speeds to be better and better in order for us to be able to do these types of Zooms or for people in your household to be able to do Zooms very easily. And so the future continues to be extremely bright for broadband. We don’t see any deceleration whatsoever.

Switching gears, there’s been a recent movement to potentially hold cable companies accountable for misinformation on cable networks. I’m curious what you think about this concept.

I’ve got my personal views. I’ll probably keep my personal views to the side. I think from a professional standpoint, our customers require and request a certain amount of content. Some of the names that were mentioned in this letter to us clearly are content and channels that our customers want. And so we’re a provider of content for what our customers want. They have the choices to not want that content…

You’re talking about Fox, Newsmax, OANN…

Yeah, the names that were were in this letter and that were broadly spoken about in the press. And for us, we want to make sure our customers are happy. And to the extent that they don’t want that type of content or other channels, they can disconnect from us and do something skinnier, or just do a Netflix or an HBO Max or Peacock. So, this is not a battle that I believe is geared towards us. This is something that consumers are choosing to do with their own feet and their own wallets today. And to the extent that for whatever reason, somebody in government thinks otherwise, they should probably not be speaking to us, but they should be speaking to someone else.

Let’s talk about the future of linear cable TV. Do you envision a day where Altice does not offer linear cable TV?

Yeah. Because the economics get worse and worse every year. As we’ve been speaking, since I’ve known you over the last five years, the story is still the same. Price levels for content continue to rise. Eyeballs for content over big bundles continue to fall.

This is an equation that continues to play out quarter over quarter in the public markets. Obviously, broadband continues to be the story and continues to make cable companies and fiber companies very attractive investment propositions because of broadband. But the pure video solution — there are truly two different types of subscribers.

There are those who have been subscribers to a video cable bundle for more than three years which are profitable. And then anyone that’s been a subscriber for less than three years is unprofitable.

So as fewer people sign up and the attachment rates on gross adds continue to decline, which is what we’re seeing, then how do you protect your long-term customers who really just enjoy still having the cable bundle? I am certain we will be able to figure out ways to work with our partners in the content world to make that transition smoothly to some type of an OTT format that’s attractive — maybe where we don’t have as much economic play in there. That way, we don’t have to deal with the diminishing returns that we are doing regularly. But at the end of the day, most content, more and more, is being consumed over broadband. As people move away from the cable bundle, by definition, everything is going to the OTT world over broadband.

Name me one person under 30 years old who has a cable video connection.

So, do I really need to be providing a bundle? I think there’s a lot of people already out there providing bundles. So I think it’s a question of time. I can’t tell you when, where and how, but it’s a question of time for cable operators in general to completely reevaluate whether or not they’re going to be in the video business.

So let me ask that question in a slightly different way. Do you envision a day where cable TV, as we know it, simply no longer exists?

Yes. For sure. Everything is going to be IP-based, and then the question is because everything is IP based, and you have so many different choices…what the cable bundle is doing today is putting together everything that’s available in the OTT world and providing it to you in a good format for you to be able to guide yourself through lots of different options in the way you watch television.

As technology and integration technology continues to get better and better, you’re going to be able to aggregate that on your OTT platforms, your smart TV. Your Samsung TV today already has, say, 20 apps, 30, 40 apps already there. The pain of it is you’re always clicking between the apps, all the time. Once you can get the whole aggregation together and make it look very similar to what you do in a cable environment, then that interactivity becomes second nature and doesn’t really matter who’s doing the bundle. It could just be your set-box provider, your smart TV provider.

So this idea that some media executives have that there’s going to be a floor at 50 million subscribers, that’s ultimately fantasy?

I think so, because name me one person under 30 years old who has a cable video connection.

I can’t.

So it’s just a question of time. People grow up in a certain way. I tell my kids all day long, how could you spend 10 hours a day on your iPhone? And they’re like, “Daddy, that’s our life. We didn’t go out in the woods and build bricks and castles and stuff like you. That stuff is boring. My whole life is on my phone.” So, there’s an evolution of technology and habits and the way people consume content that’s changed dramatically over the last ten years, and it’s going to continue to change.

Do you feel like this transition to streaming is good for the industry? It seems to me there’s a scenario where media companies, by and large, end up with worse financial results in a streaming world compared to the cable world.

Listen, I’m not running a media company today, but I do think there’s some truth in what you say. When people start getting valued on an OTT subs basis, that are probably returning less money than affiliate fees coming from a cable operator to them, it doesn’t psychologically make sense.

Maybe you can distribute a lot quicker through an OTT platform than you can today. But as you continue to slice and dice habits for what people watch on TV, I think people will start leaving a lot of some of the traditional content providers. People are going to say, listen, I don’t need CBS All Access, or Peacock, or Discovery+, whatever it is. There will be a lot of people who do subscribe, but there will be people who’ll just walk away from it completely. So, time will tell.

Markets are a little bit crazy for growth right now. But in a couple of years, as this all settles out. There’s already starting to be some winners and losers. Already in my household, you know that people want Netflix and Disney+ because you have children. But do you need Hulu, HBO Max, Peacock and Discovery+? All of it? My kids don’t want that.

My kids yell at me when I turn on HBO Max. Seriously. “No, not HBO Max!” They know I watch adult stuff there and their kids’ programming isn’t that good. They’re not that into Sesame Street.

That’s exactly right. Our children are going to be holding the wallet in 20 years, and they’re going to have their preferences about how things are run.

The big three wireless operators in this country have championed their 5G products as true competitors to cable broadband. Do you feel 5G wireless is a real threat to your broadband dominance?

No. I mean, you’d expect me to say that, but I really don’t. I believe it is complementary. People want better and better broadband connectivity inside and outside of the home.

At the end of the day, a wireless connection, no matter what technology, 5G, 10G, whatever you want to call it, it ultimately terminates on a fixed line. And it has to go through a fiber connection because the fiber connection ultimately takes it out to the World Wide Web and allows you to have connectivity.

If wireless has to connect through airwaves to ultimately a fixed line connection, that connectivity always is going to be less productive and robust than a full end-to-end fiber-to-the-home connectivity, not only from a performance standpoint and a bandwidth standpoint but purely from a price standpoint. The price per gig over wireless is more expensive than the price per gig over fixed because the marginal costs are de minimis over fixed where there are marginal costs on wireless.

If everyone was on an unlimited plan that was never throttled on wireless, and they were consuming 400 to 500 gigs of data like we see from our fixed line customers, the entire wireless infrastructure would explode.

So, you need both, and you do want good connectivity when you’re outside the house, but when you’re driving, you don’t need necessarily to have the most amazing connectivity. 5G is going to allow smart cars. Your Apple carplay is going to work well. But you’re not interacting when you’re driving. You have shorter periods of time when you’re going on the subway or a train to commute. And then when you’re in the office, you’re back on a fixed line network. So people will subscribe to 5G. Absolutely. Because they want better and better service from a wireless standpoint. But I don’t believe it will replace in any shape or form nor be able to compete, broadly speaking, with fixed-line cable.

Some cable companies have dabbled in a couple of adjacent industries — home security, telehealth. I’m curious if you think there’s a thus far unexplored or moderately explored business that could fit nicely with the cable industry?

When you think about the big technology companies, they’ve attacked your home through an app. Pretty much through search or through an app or through some type of service. When you think about wireless companies, they’re attacking the consumer for all of their activity outside of the home or within the home connected to a Wi-Fi network.

When you talk about a cable company or a fixed line company, those companies are attacking the home from the household. You start from the TV. You own the broadband connection. What else can you do?

Everything is converging around smartness, right? Whether it’s your refrigerator or your coffee machine that’s talking to you, whether you’re able to do telehealth seamlessly from your home, ultimately, everything deals with broadband connectivity.

And so, where we stand today, yes, telehealth is something that’s there, home security is something that’s there, but why are we not also in the consumer goods products, or the smartness of the consumer goods side? All of the 5G Internet of Things type of speak, why are we not playing in that as well?

I believe that’s why everything is converging between technology companies — traditional technology companies, wireless companies and fixed-line companies — because everyone is attacking the subscriber at home and its behavior. And everyone has a different piece of that pie today. But there’s no reason why you shouldn’t be able to own more pieces of the pie.

Last question: Investors are going to be reading this and they’re going to want to know how should I play cable? Outside of Altice, which of course you have the vested interest in, what would you tell them? Should they be investing in towers or the fiber providers or the operators themselves? Is there a smart way to play this from an investment standpoint?

Of course, I’m going to tell you what I think relative to my own book. But what’s true and continues to be true and will be true for a very long time forward is broadband connectivity. Penetration is continuing to rise, and cable companies continue to be at the forefront of dominating market share, and people are going to continue to want to upgrade their speeds and get better and better technology.

I think you can say that in wireless as well. But there is a big difference, which is with wireless, you’re also replacing your handset every two or three years. That’s an expensive thousand dollar purchase, if you’re buying the high end stuff. Secondly, the difference between 4G and 5G, or 3G and 4G, are not so cataclysmic that it warrants major price improvements in terms of what consumers are willing to pay. And I do think that competition in the wireless world is getting probably more competitive than less competitive, in general. So we’re big believers in fixed-line infrastructure — that fiber to the home continues to be the best technology out there, and that will continue to be dominant in terms of how consumers and enterprises and small businesses use them. We like that economic free cash flow yield that we think is very predictable and continues to grow.

That growth of free cash flow and predictability of free cash flow is something quite unique. And it’s very much the cable story and the fixed line story today.