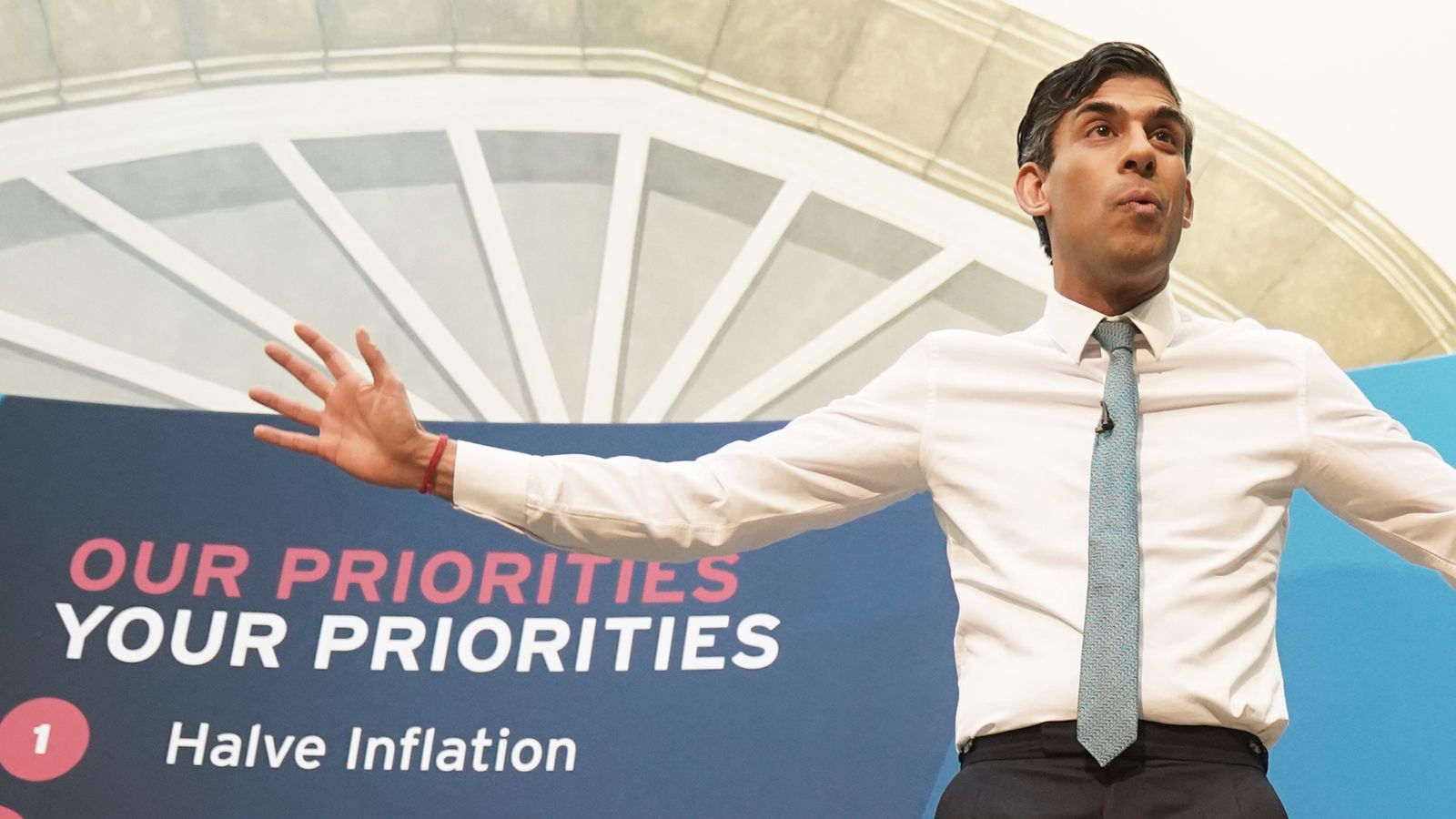

Halving inflation by the end of year is “hard but not impossible”, the prime minister has said, in a comment on his pledge earlier in the year to do so.

The prime minister was speaking to the Times CEO summit shortly after the surprise hiking of interest rates by the Bank of England on Thursday to 5%.

This followed the announcement the day before that inflation was stuck at 8.7%.

Politics latest: Sunak ‘feels moral responsibility’ to cut inflation

Mr Sunak said: “Clearly what’s happened in the last couple of months makes that harder, of course it does. That goes without saying. But I’ve always said this would be hard.

“It’s clearly become more challenging and it’s clearly become harder, but it’s not impossible and we’re throwing absolutely everything at it, and that’s what I’m doing.”

He said earlier that “clearly it’s got harder over the past few months” to bring down inflation.

Interest rates are set by the bank independently of the government and impact the cost of borrowing money, while inflation charts how quickly prices are rising.

Mr Sunak made his primary pledge at the start of 2023 to “halve inflation” from just over 10% to around 5% by the end of the year.

Earlier in the day, Downing Street refused to say if Bank of England governor Andrew Bailey was doing a good job.

The bank has a target to bring inflation down to 2%.

Speaking to journalists during the daily briefing, the prime minister’s spokesman said Mr Bailey still had Rishi Sunak’s support.

He was repeatedly asked if the central bank chief was doing a good job in tackling inflation, but did not respond in the affirmative.

This took place shortly before the surprise interest rate hike.

The Number 10 spokesman said: “The prime minister thinks it is important that we continue to support the bank in the work they are doing.

“You’re aware that there’s an independent process for setting interest rates, and we continue to work closely with them and work well with them to bring down inflation.”

Ed Conway: Scale of rate hike is shock therapy for UK’s inflation problem

Downing Street added that the Bank of England “continues to have the prime minister’s support”.

“It’s right that we continue to support the Bank of England as they take the independent decisions on interest rates,” the spokesman said.

Speaking to Sky News the night before, Transport Secretary Mark Harper hinted at the government’s dissatisfaction with the governor.

He highlighted that “there was a decision to make at the beginning about whether inflation was transitory or not”.

Chancellor Jeremy Hunt wrote to Mr Bailey, following the inflation announcement, to say the bank has his “full support”.

And speaking following the 0.5 percentage point rise, shadow chancellor Rachel Reeves defended the independence of the Bank of England – which was introduced in 1997 after Tony Blair came to power and Gordon Brown became chancellor.

Ms Reeves said the independence is “one of the greatest achievements of the last Labour government”, adding that the Conservatives have “spent a large proportion of last year undermining the independence of the bank”.

Click to subscribe to the Sky News Daily wherever you get your podcasts

Sir Ed Davey, the leader of the Liberal Democrats, said that “homeowners are being treated as collateral damage by Rishi Sunak”.

“This latest rate rise will scar family finances for years to come, all because this Conservative government crashed the economy and sent mortgages spiralling,” he said.