Jeremy Hunt has promised to help families with “permanent cuts” in tax on the eve of the budget on Wednesday.

The chancellor, who is expected to announce a 2p reduction to national insurance (NI) in what could be the last major fiscal event before the next election, said “lower tax means higher growth”.

While he did not confirm what taxes he plans to slash, Sky News understands that a cut to NI is on the cards and the 5p freeze on fuel duty will be extended.

Money:

What 2p cut to national insurance means for your pay

Mr Hunt is also said to be considering:

• A new levy on vaping products

• Help for first time buyers, such as 99% mortgages

• A tax on air passenger duty for business class travel

• Cutting back plans to increase departmental spending to save money

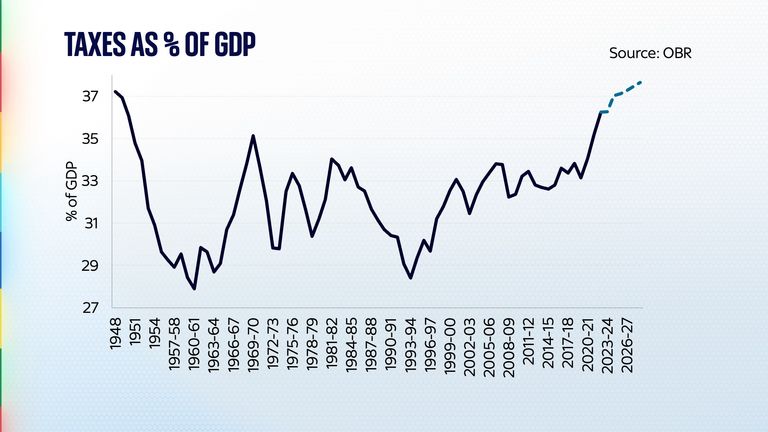

Labour said that whatever is announced, it won’t be enough to “undo the economic vandalism of the last decade” – and the tax burden is still set to rise to a record high.

With Sir Keir Starmer’s party ahead by around 20 points in the polls, some Tory MPs want Mr Hunt to go further and cut personal income tax with an election approaching.

This is seen as a more headline-grabbing measure that benefits more voters, including pensioners.

But the chancellor is said to have decided against this after forecasts from the UK’s fiscal watchdog, the Office for Budget Responsibility (OBR), gave him less fiscal headroom than hoped.

‘Conservatives know lower tax means higher growth’

A 2p cut to income tax would cost around £14bn, whereas the 2p cut to NI will cost around £10bn.

Combined with the 2p cut to NI announced in November, the move will save 27 million workers £900 on average.

In comments released by the Treasury on Tuesday night, Mr Hunt said: “Of course, interest rates remain high as we bring down inflation.

“But because of the progress we’ve made… delivering on the prime minister’s economic priorities, we can now help families with permanent cuts in taxation.

“We do this not just to give help where it is needed in challenging times. But because Conservatives know lower tax means higher growth. And higher growth means more opportunity and more prosperity.”

Mr Hunt added that growth “cannot come from unlimited migration”, but “can only come by building a high-wage, high-skill economy”.

He also took aim at Labour, claiming a government under Sir Keir Starmer would “destroy jobs” and “risk family finances with new spending that pushes up tax”.

Politics latest:

Will another NI cut appeal to voters?

Tories ‘overseeing 14 years of economic failure’ – Labour

But shadow chancellor Rachel Reeves said Labour is “now the party of economic responsibility” as she accused the Tories of overseeing “14 years of economic failure” with the overall tax burden still rising.

She said: “The Conservatives promised to fix the nation’s roof, but instead they have smashed the windows, kicked the door in and are now burning the house down.

“Taxes are rising, prices are still going up in the shops and we have been hit by recession. Nothing the chancellor says or does can undo the economic vandalism of the Conservatives over the past decade.

“The country needs change, not another failed budget or the risk of five more years of Conservative chaos”.

Read more:

Hunt’s task is not just to get voters on side – but MPs too

What to expect in the budget – from tax cuts to fuel duty

How will Hunt pay for Budget 2024 giveaway?

Experts have warned that a 2p national insurance cut would not be enough to stop the tax burden rising because of previously announced freezes to personal tax thresholds.

There are also questions about whether Mr Hunt can afford to pay for the measure.

He has said he will not pay for tax cuts with borrowing, meaning a combination of spending cuts and tax rises elsewhere will be necessary.

Revenue-raisers Mr Hunt is said to be considering include reducing the scope of non-dom tax relief, which Labour has said it would scrap to fund services such as the NHS.

A new levy on vaping is on the cards, as is a tax on air passenger duty for business class travel and a tax crackdown on those who rent out second homes for holiday lets.

The chancellor is also considering cutting back plans to increase departmental spending by just 0.75% a year, instead of 2%, to raise around £5bn.

While this would create more scope for tax cuts, it would likely prove controversial given the pressure already on public services, with a spate of local councils going bankrupt in recent months.

Lib Dem leader Sir Ed Davey – who will be targeting Mr Hunt’s “Blue Wall” seat at the election – described the Conservatives as “the great tax swindlers” and said they should be prioritising the NHS.

He said: “Rishi Sunak has led the economy into a recession and forced families to pick up the tab. They have no shame.

“The Conservatives must put the NHS at the heart of the budget. It is no wonder the economy isn’t growing when millions of people are stuck on NHS waiting lists, unable to work.”

Watch Sky News’s coverage of the Budget live from 11am on Wednesday.