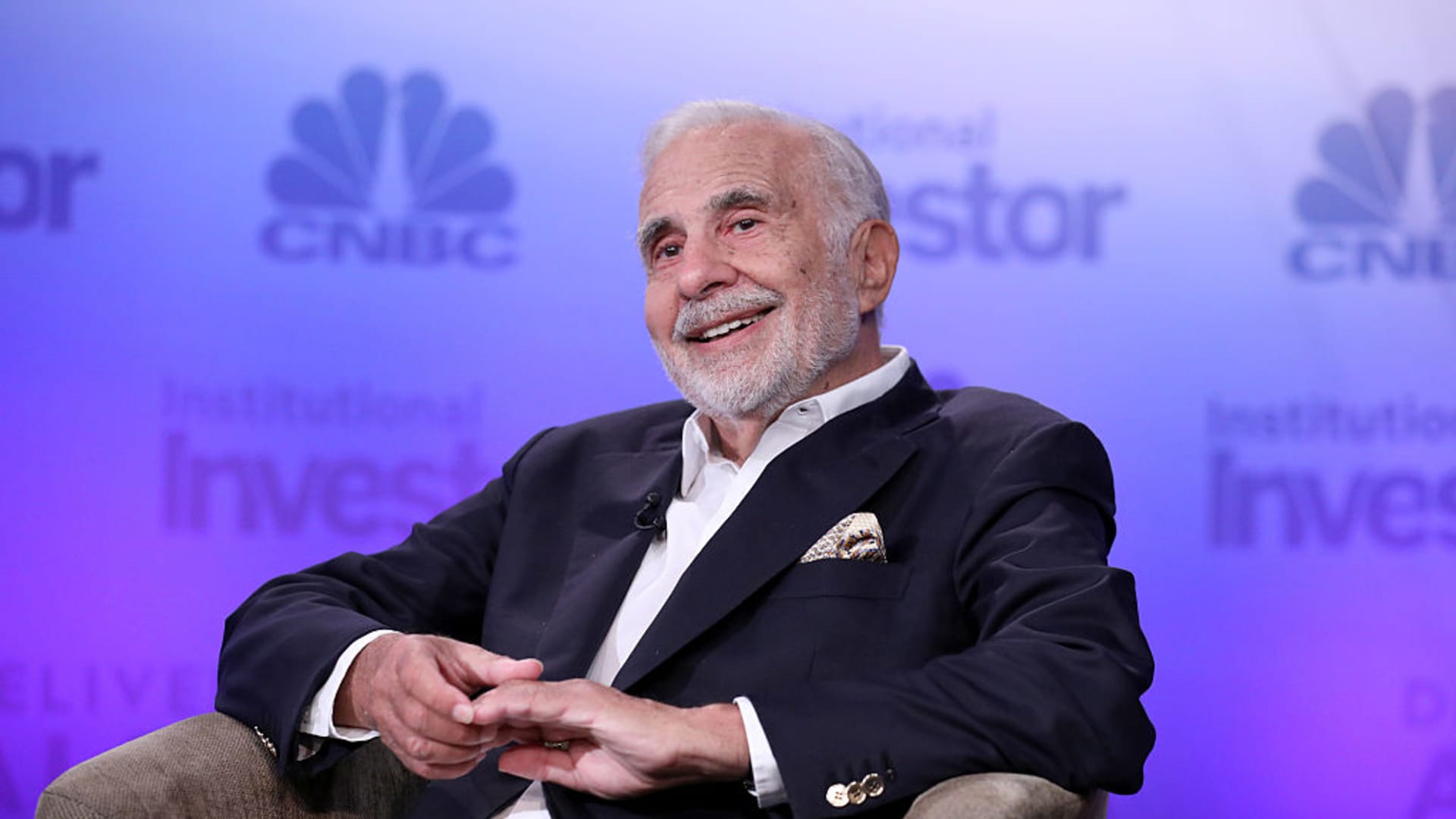

Activist investor Carl Icahn on Monday reported a nearly 10% stake in JetBlue Airways, saying the airline stock is undervalued. Shares of JetBlue spiked more than 15% in extended trading.

Icahn amassed the stake in a series of purchases in January and February, according to regulatory filings. He has had and plans to continue discussions with the company “regarding the possibility of board representation,” the records said.

JetBlue said in a statement, “We are always open to constructive dialogue with our investors as we continue to execute our plan to enhance value for all of our shareholders and stakeholders.”

Representatives for Icahn were not immediately available to comment.

This is not Icahn’s first investment involving the airline industry. In one of his more infamous activist campaigns, the corporate raider took TWA private in the late 1980s, only to see the airline struggle and file for bankruptcy.

JetBlue has been cutting costs and working to improve operations in an effort to return to profitability after a post-Covid travel surge and a blocked merger with budget carrier Spirit Airlines. A federal judge last month ruled against a combination of the two airlines, citing reduced competition.

JetBlue had argued it needed the tie-up to help it compete against the largest American carriers. JetBlue and Spirit are appealing the judge’s ruling.

In the last 12 months, JetBlue’s stock is down more than 27% as of Monday’s close. The NYSE Arca Airline index, which tracks the broader sector, is up nearly 7% over the same period.

JetBlue’s new CEO, Joanna Geraghty, took the helm Monday, and the carrier has appointed a pair of airline veterans to get it back on track.

— CNBC’s John Melloy and Leslie Josephs contributed to this report.