Shares of Canadian telecommunications satellite operator Telesat surged on Friday after the company announced it would swap suppliers for its planned Lightspeed global internet network.

Canadian space company MDA will now build the Lightspeed satellites, taking the place of French-Italian manufacturer Thales Alenia Space and resulting in “total capital cost savings” of about $2 billion, Telesat announced.

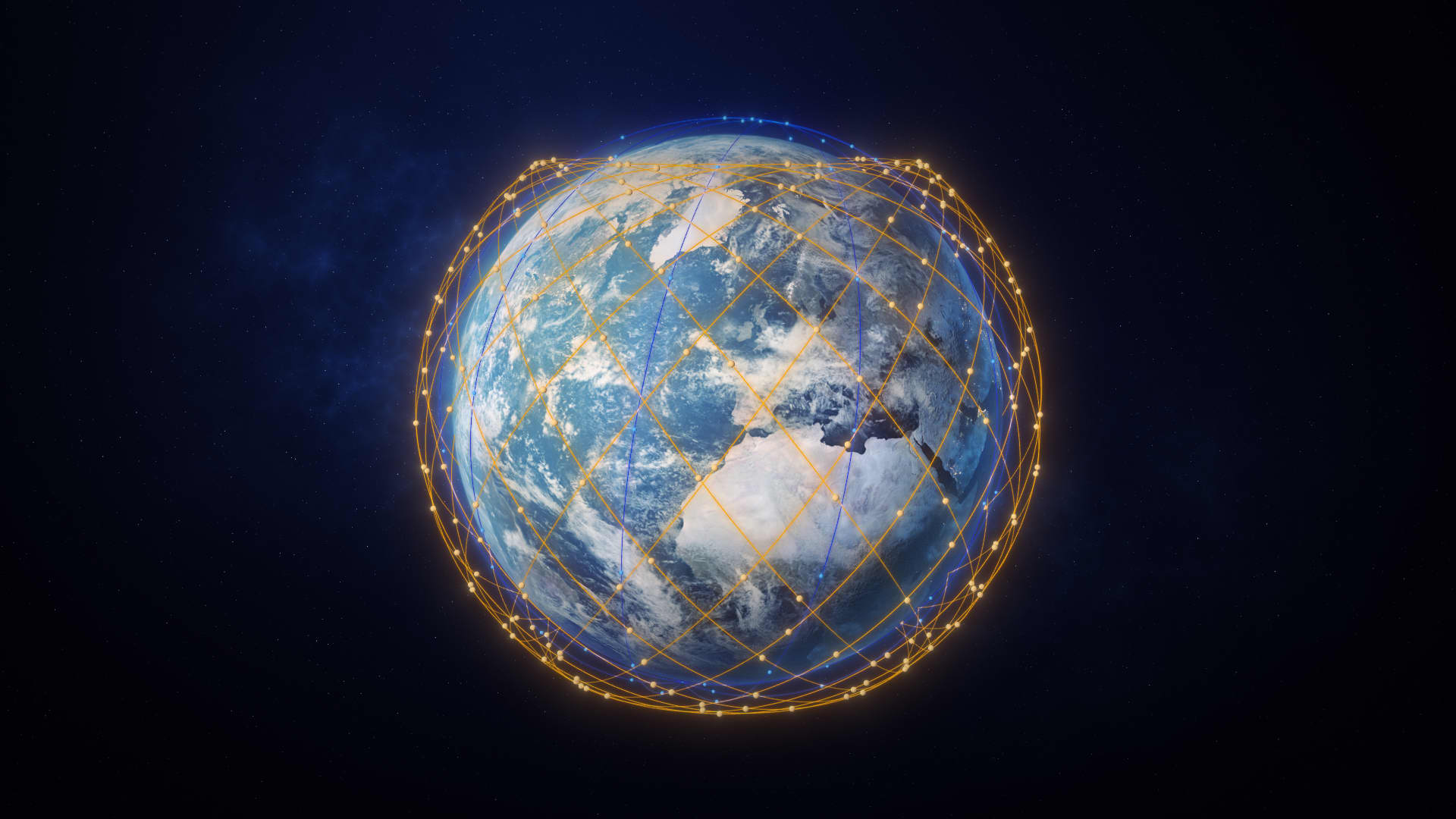

The company expects to begin launching the first Lightspeed satellites in mid-2026, with global service beginning once the first 156 satellites are in orbit. The full network is planned to consist of 198 satellites.

Telesat stock surged as much as much as 64% with heavy volume in early trading from its previous close at $8.45 a share, before slipping slightly to closer to 50%.

“I’m incredibly proud of the Telesat team for their innovative work to further optimize … resulting in dramatically reduced costs,” Telesat CEO Dan Goldberg said in a release.

The company had previously contracted Thales Alenia Space to manufacture the satellites at an estimated cost of $5 billion to build the network – including about $3 billion for the satellites, plus the costs of rocket launches, building ground infrastructure and developing software platforms to operate the network.

Goldberg previously emphasized to CNBC that Lightspeed is not intended to compete in direct-to-consumer markets against SpaceX’s Starlink or Amazon’s Kuiper. Instead it will maintain Telesat’s existing focus on enterprise customers – government and commercial markets that Starlink has expanded into in the past year.

Telesat also reported second-quarter results on Friday, including $180 million in revenue, a decrease of 4% from the same period a year prior. Telesat’s net income jumped to $520 million in the quarter, compared to a net loss of $4 million a year prior – a dramatic shift the company attributed largely to a $260 million payment from the FCC for clearing spectrum for 5G use in the U.S.

The company reaffirmed its full-year 2023 revenue guidance, expecting to bring in between $690 million and $710 million.