Tens of thousands of people are facing crippling tax demands from HMRC for tax their employers failed to pay. It’s an injustice that has been compared with the Horizon scandal.

At least 23 victims have taken – or attempted to take – their own lives.

For the first time, two of those who tried to end their lives have shared their story with Sky News.

This story contains references to suicide that readers may find distressing.

“I went for a drink. And I don’t remember – I know why I did it – but I don’t remember making the decision to do it.

“The next thing I truly remember is waking up in St Thomas’ Hospital with a dislocated shoulder and blood all over my face. Because I stepped in front of a minicab.”

In the depths of his depression, this felt like the most sensible decision in the world to Mark*.

For several years, he had been receiving letters from HMRC demanding he pay tax that his employers failed to pay.

The sums were staggering, and the financial and psychological toll unbearable.

Mark is not alone. Tens of thousands of people across the country are also facing crippling tax demands from HMRC.

It’s a campaign that has driven people to the brink of bankruptcy, devastated families and has been linked to 10 suicides.

At least 13 people have attempted to take their own lives. Many have battled with shame and fear, often hiding the truth from their families while slowly trying to rebuild.

Mark received the first letter from HMRC seven years ago but “there’s been a constant drip of letters ever since”.

It informed him that he had been hit with something called the Loan Charge. The policy came into force in 2017 through a piece of legislation that targeted people – often agency workers – who were paid their salaries through umbrella companies.

Some of these companies were actually operating tax avoidance schemes that would pay individuals a loan instead of a salary.

Workers saw deductions on their payslips but these were fees pocketed by the promoters. As these were loans, the companies did not pay the necessary tax and national insurance.

HMRC and the Treasury slowly became alert to the scale of the missing tax revenue and sought to recoup it – not from the companies but from the individuals.

These schemes were deemed to be disguised remuneration and, in his 2016 budget, former chancellor George Osborne brought in the Loan Charge. The law was passed by parliament and made individuals liable for tax that the employers should have paid.

Typically, this affected agency workers, including nurses, supply teachers and council workers. Many had little or no choice but to take on work through these companies and had no idea they were being paid in loans. In many cases they were missold.

‘My initial reaction was to laugh’

Mark was asked to pay £60,000 from his time working as an IT contractor.

“I think my initial reaction was to laugh. Because it was obviously ridiculous,” he said.

“Back then I was very naive and I assumed that I could call HMRC and have a conversation with them about it. They would realise that mistake had been made and everyone would laugh or walk away from the table. That’s not what happened at all.

“I contacted them and they said no, you owe this money and you need to pay it and I think they gave me a ridiculously small timescale to find that much money. I think it was 30 days.

“And then it started to dawn on me that this was actually quite serious.”

Mark continued to say: “Ever since that point, I’ve been under that constant pressure of feeling the impact of this Loan Charge on me. It hasn’t stopped.

“I try to forget about it. I’ve had good and bad days. I have days when I just completely forget that it exists. And I have other days when it is so oppressive and so incredibly overwhelming.”

HMRC even contacted his partner while she was in hospital receiving treatment for breast cancer to ask about Mark’s whereabouts. The agency sent a £150 cheque in the post by way of apology.

While some of those who engaged in loan schemes did so with the explicit intent to minimise their tax bills, many were simply trying to do the right thing.

In many cases, individuals were advised by their recruitment agencies to sign up to the umbrella companies, helping them to avoid the complicated process of setting up a limited company.

Others, like Mark, turned to the umbrella companies because they were worried about falling foul of new IR35 rules – originally designed by Gordon Brown – that clamped down on contractors operating as limited companies.

‘A cloud hanging over you’

For Dylan*, the final straw was a letter that arrived on Easter Saturday, around this time last year.

“There was no one to ring to talk to. There was no way to contact the HMRC office or the number on the letter,” he said.

Dylan’s mother found him shortly afterwards. Her son had overdosed.

He described his experience as one of “absolute exhaustion and fear”.

“(It’s) a cloud hanging over you. If you have a good experience, it still creeps in that this is hanging over your head and it kind of sours everything. And that’s kind of how a lot of us live. And I’m experiencing it and it is horrible,” he said.

HMRC contacted him again while he was recovering in hospital, which Dylan said “compounded the stress and the trauma they put me through”.

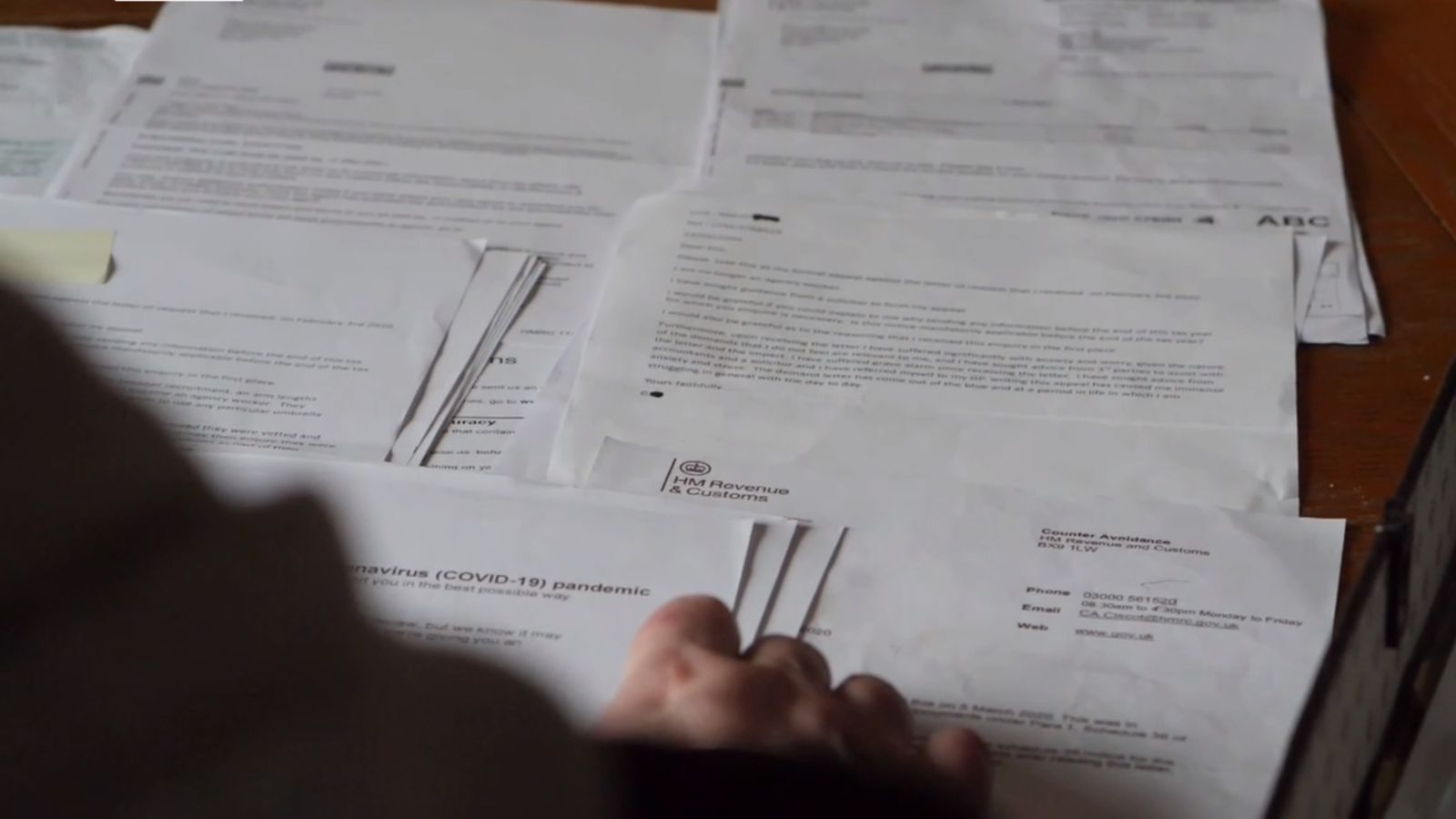

Today he is in a better place – but he struggles to relive the trauma while sitting at his dining room table, which is covered in letters.

He holds up one from his recruitment agency, which reassured him that the company he was being paid through was HMRC compliant.

He said: “Each letter that you get, or each email or phone call, is akin to death by a thousand cuts. It’s just always chipping away, and you’re always terrified of the next one coming.”

Sky News spoke to others who were too frightened to share their stories with the public. One victim said the experience took an enormous toll on his marriage.

“It changed the person I was,” he said.

“With these letters, I had been thinking about suicide for a little while. And then I was chopping up some food and I realised I’ve got a knife and I kind of held it on my wrist. And I thought now’s the time.

“And I found it weird because I wasn’t scared. I just felt peaceful. Like it would be a relief just to get it done and it’s only because my son came in asking for something. It was only that that sort of shocked me out of it.”

For both Mark and Dylan, the affair took a mind-bending turn.

Along with the brown envelopes from HMRC, they started receiving letters in the post from companies based offshore demanding they repay the loans – what they assumed was their salary.

The original umbrella companies had sold on the loan book to third parties. Many of these companies are owned by a closely connected web of people.

Targeting the wrong people

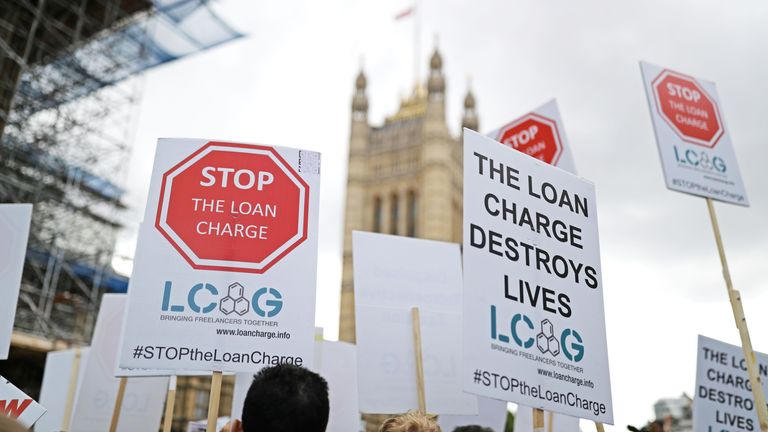

The consequences of the Loan Charge have been devastating. Tax lawyers have described it as an unjust campaign that is targeting the wrong people and undermining the rule of law by overriding statutory taxpayer rights.

For years HMRC failed to take action against these schemes, which resulted in widespread underpayment of income tax and national insurance.

The courts have since ruled that the employers or agencies should have been paying tax to the exchequer. However, the Loan Charge legislation overrode that – allowing HMRC to pursue individuals in lieu of the agencies or employers and to go back as far as 20 years into someone’s tax affairs.

Keith Gordon, a tax barrister, said: “When the contractors were paid, the PAYE rules applied and were meant to ensure the tax was deducted from salary before it was received by the workers. That PAYE was not paid.

“The workers suffered a deduction but that was just simply taken as fees by the promoters of the schemes which were running rather dubious tax avoidance of agents without contractors’ knowledge.”

He suggested that HMRC were targeting individuals instead of the organisers of the schemes, many of which are based offshore, because it was an easier route to recoup the money.

Mr Gordon added: “Number one: the promoters have deeper pockets and might be able to fight back against unfair legislation. Number two: that would probably amount to admitting the revenue made a mistake in the first place.

“Number three: some of these promoters are now insolvent because they’ve had plenty of years to wind up their affairs and become out of the reach of the tax authorities.”

Many of the companies have since been dissolved, although HMRC admitted that new promoters continue to enter the market.

A recent government report concluded: “We estimate there are currently around 70 to 80 non-compliant umbrella companies involved in the operation of disguised remuneration avoidance schemes.

“Many of these umbrella companies are short-lived, typically operating for less than two to three years before closing down, before a new umbrella company is set up and starts operating new avoidance schemes.”

HMRC has warned recruitment agencies that they face penalties if they refer people to non-compliant umbrella companies but would not respond to questions about how many recruitment agencies it has investigated.

MPs and tax lawyers are calling for the agency to rescind the policy, arguing that it is a retrospective charge that overrides taxpayers’ statutory protections by dismissing time limits on HMRC’s right to investigate tax affairs, and by blocking individuals’ rights to fight their case in court.

It is also without any legal precedent. The courts have repeatedly rejected HMRC’s interpretation that income tax can be applied on loans to individuals.

A 2017 Supreme Court ruling put the onus on the employer to deduct income tax before loans were advanced to an individual and a 2019 parliamentary report concluded that “the Loan Charge is in defiance of the rulings of the court… no court case has given the legal basis for the Loan Charge”.

Bills ran into hundreds of thousands of pounds

Still HMRC, backed by this legislation, continues to pursue individuals.

Five years ago, the agency started sending letters to people, explaining that these schemes were “disguised remuneration,” imposing a tax liability on what it now classified as income and applying interest – then urging them to settle.

In some cases, the bills ran into the hundreds of thousands of pounds.

Those who could or would not pay were warned that they would be hit with a Loan Charge, typically a much larger amount because the total sum was taxed in a single year, often applying a 45% tax rate on the income.

It meant that in many cases people were paying back far more than they would have done if they weren’t part of the schemes.

HMRC threatened to seize people’s possessions and sell them at auction if they didn’t find the money. In some cases the agency set up payment plans but in others, people had no choice but to take out further loans.

Tens of thousands of people fear bankruptcy and they could be forced to hand over cash if and when they sell their homes.

The agency has referred cases of suicide to the Independent Office for Police Conduct (IOPC), which oversees certain serious complaints about the conduct of tax inspectors.

Campaigners have repeatedly warned of the risk of further suicides and have demanded that HMRC provide a 24-hour suicide prevention helpline.

An HMRC spokesperson said: “We appreciate there’s a human story behind every unpaid tax bill and we take the wellbeing of all taxpayers very seriously. We recognise that dealing with large tax liabilities can lead to pressure on individuals and we are committed to identifying and supporting customers who need extra help, and we have made significant improvements to this service over the last few years.

“We have support in place to help customers who have used a tax avoidance scheme to settle their use. This includes paying by instalments in a Time to Pay Arrangement. The arrangement we agree will be based on what the taxpayer can afford and there’s no upper limit over how long we can potentially spread payments.

“Our message to anyone who is worried about paying what they owe is: please contact us as soon as possible to talk about your options.”

*Names have been changed

Anyone feeling emotionally distressed or suicidal can call Samaritans for help on 116 123 or email jo@samaritans.org in the UK. In the US, call the Samaritans branch in your area or 1 (800) 273-TALK.