IBM shares rose as much as 6% in extended trading on Wednesday after the technology conglomerate surpassed analysts’ estimates for the third quarter and lifted its growth projection for the full year.

Here’s how the company did:

- Earnings: $1.81 per share, adjusted, vs. $1.77 per share as expected by analysts, according to Refinitiv.

- Revenue: $14.11 billion, vs. $13.51 billion as expected by analysts, according to Refinitiv.

Revenue increased 6.5% from a year earlier, according to a statement.

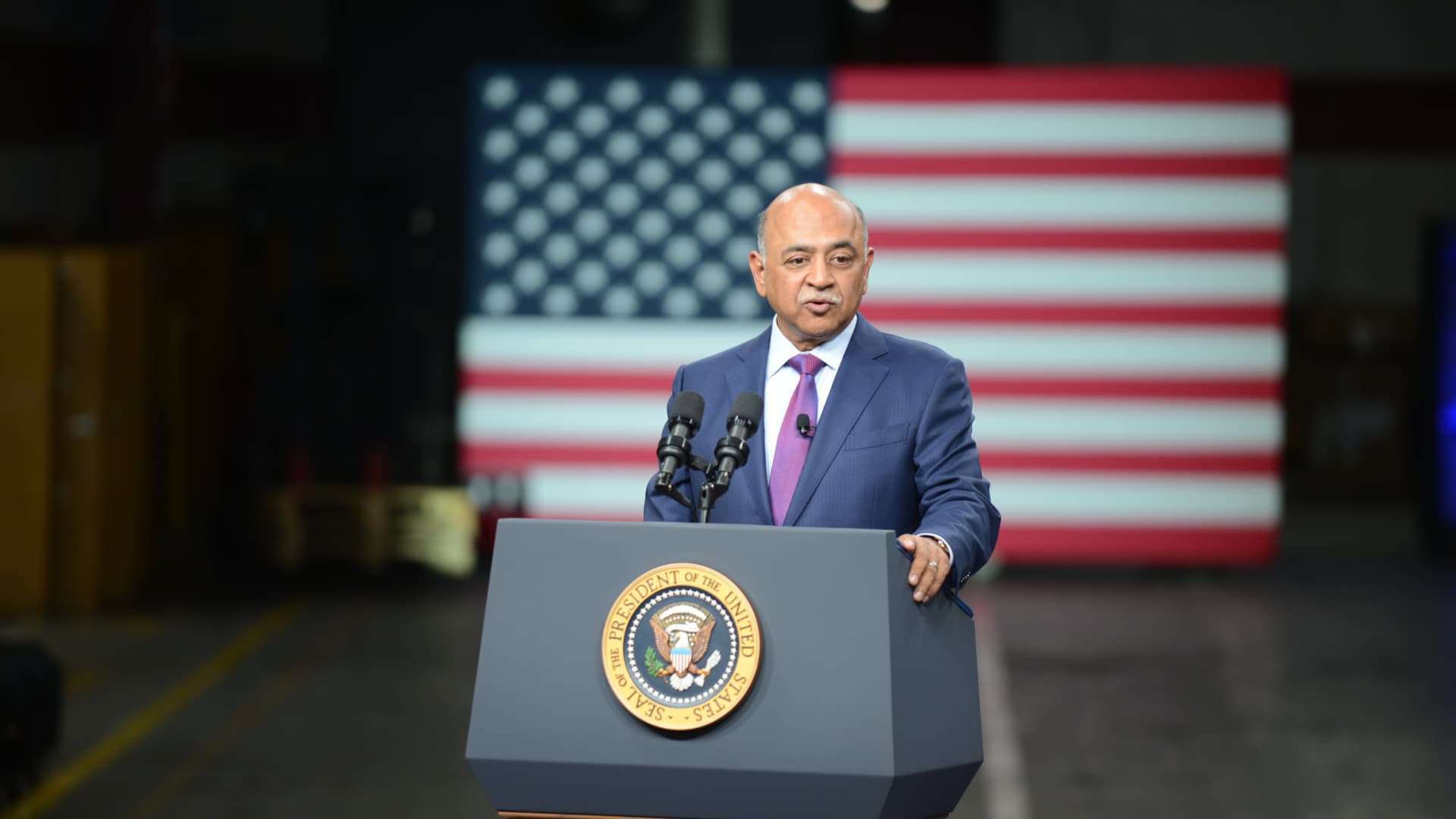

“With our year-to-date performance, we now expect full-year revenue growth above our mid-single digit model,” CEO Arvind Krishna said in the statement. In July the company said it had expected growth at the high end of the model.

The company said foreign-exchange rates should result in 7% less revenue than it otherwise would generate in the full year. IBM reiterated its guidance from July of around $10 billion in free cash flow.

“I certainly hope that we are seeing the end of the dollar strengthening,” Krishna said on a conference call with analysts.

In Europe, the energy crisis and inflation are making for more cautious conversations, but the concerns aren’t reflected yet in the data, Krishna said.

The company ended the third quarter with a $3.21 billion loss from continuing operations, compared with income of $1.04 billion in the year-ago quarter. IBM spun off its managed infrastructure services business into Kyndryl in November 2021. During the third quarter IBM paid a one-time non-cash pension settlement charge tied to the transfer of some pension obligations and assets to third-party insurers. IBM reported an adjusted pre-tax margin of 13.9%, while analysts polled by StreetAccount had been looking for 15.1%.

Revenue from software totaled $5.81 billion. That represents growth of nearly 7.5% year over year and exceeds the $5.54 billion consensus estimate among analysts polled by StreetAccount. About 8% of software revenue came from a commercial relationship with Kyndryl, said Jim Kavanaugh, IBM’s finance chief, on the conference call. Revenue from transaction processing software grew 23%.

Consulting revenue came to $4.70 billion, which was up 5.5% and above the StreetAccount consensus of $4.51 billion. Pre-tax margins in the consulting unit narrowed to 9.8% from 10.5%. Continued labor cost inflation factored into profit for the unit, IBM said. “However, coming out of the third quarter, we are seeing signs of progress,” Kavanaugh said, flagging higher utilization rates.

The infrastructure segment delivered $3.35 billion, up 14.8% and higher than the $3.06 billion StreetAccount consensus. Revenue from IBM’s z Systems line of mainframe computers jumped 88%. Sales of the z16 mainframe computer began in the second quarter.

“Mainframe hardware had a strong start,” Krishna said.

During the quarter IBM announced the acquisition of consulting firm Dialexa and observability software startup Databand.ai, along with new servers containing its Power10 chips.

Notwithstanding the after-hours move, IBM shares have fallen 8% so far this year, while the S&P 500 U.S. stock index is down almost 23% over the same period.

Correction: A prior version of this story had the incorrect figure for revenue growth.

WATCH: Longer sale cycles for cloud software companies have investors feeling hesitant