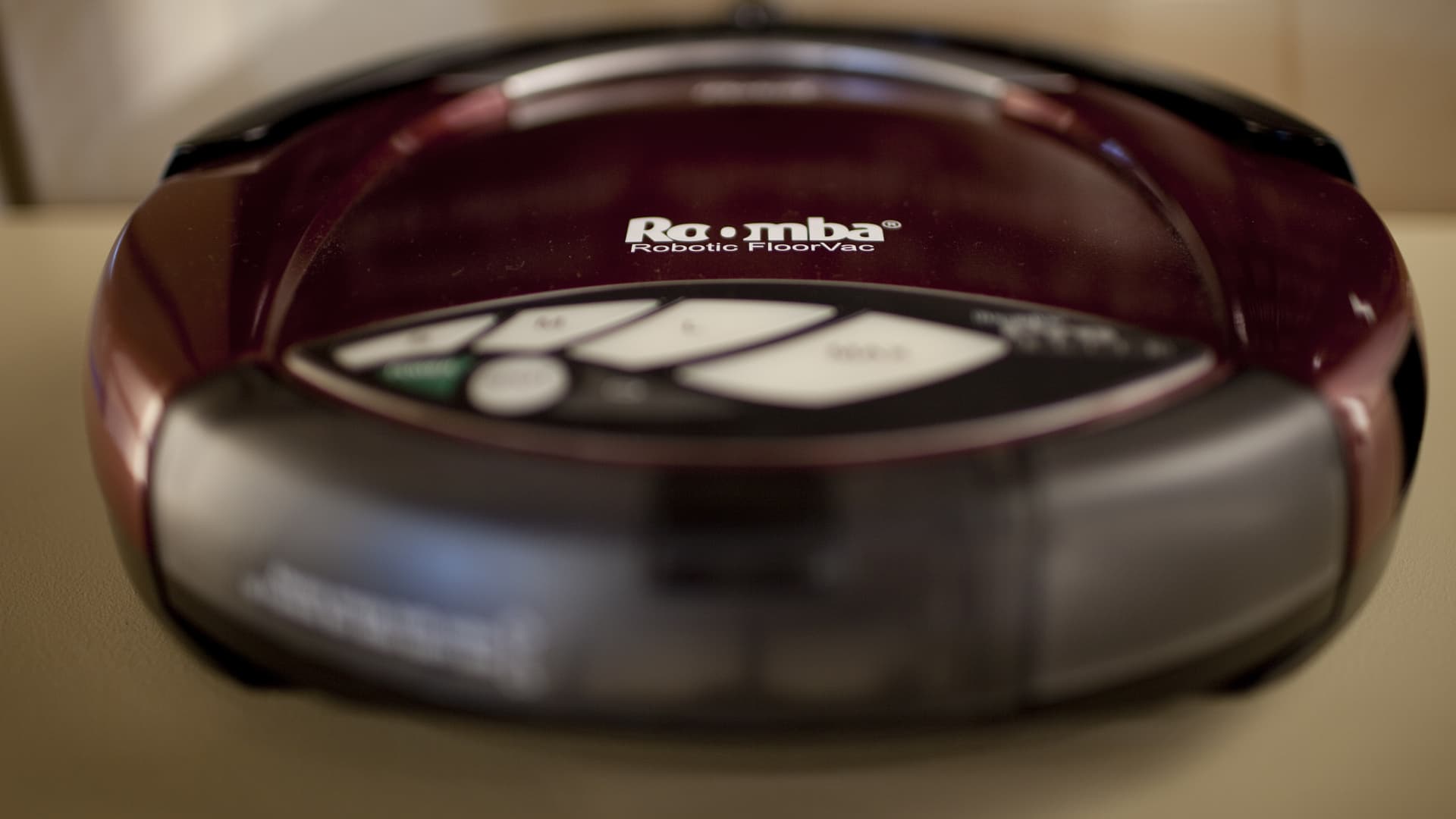

Amazon‘s planned $1.7 billion acquisition of iRobot, the maker of Roomba vacuums, has been greenlit by Britain’s competition watchdog.

The Competition and Markets Authority said it determined the deal would not result in “a substantial lessening of competition” in the U.K. The CMA opened its probe into the proposed purchase in April.

iRobot’s stock climbed more than 19% in early trading on news of the CMA’s approval. Amazon shares were flat.

An Amazon spokesperson told CNBC in a statement: “We’re pleased with the UK Competition and Markets Authority’s decision and are committed to supporting regulatory bodies in their work. We look forward to similar decisions from other regulators soon.”

Amazon announced last year it would acquire iRobot for $1.7 billion, as part of a move to deepen its presence in the smart home. But the deal is still under review by the U.S. Federal Trade Commission, as well as European Union antitrust regulators, who opened a probe earlier this month.

The CMA said it found in its review that iRobot’s market position in the U.K. is modest and that it faces significant competition from several rivals. It also determined the deal would not limit rival smart home platforms’ ability to compete and that there was no clear incentive for Amazon to favor iRobot’s products on its online store.

WATCH: Amazon’s smart home dominance and how it could grow with iRobot acquisition