The global insurance space is reeling as the worldwide protection gap has now crossed the 1 trillion US dollar mark. An insurance gap is the difference between economic losses and insured losses. In the broader acumen, however, it provides evidence the global economy has become less resilient under stress and may not be prepared to fully recover from significant impacts.

While at Google, Dr. Henna Karna, who led as General Manager for Google’s Global Insurance & Risk Management Industry Solutions, believes that the rising insurance gap is not a sign to ignore for future generations. It’s an indication of weakening constructs, leaving homes uninsured (e.g. Florida and California) and limited insights on emerging risks. Dr. Karna is endlessly working with large and mid-size companies to address this.

Focused on tackling the issue of the global protection gap, she recognized “analytics @ scale” as the most sustainable solution.

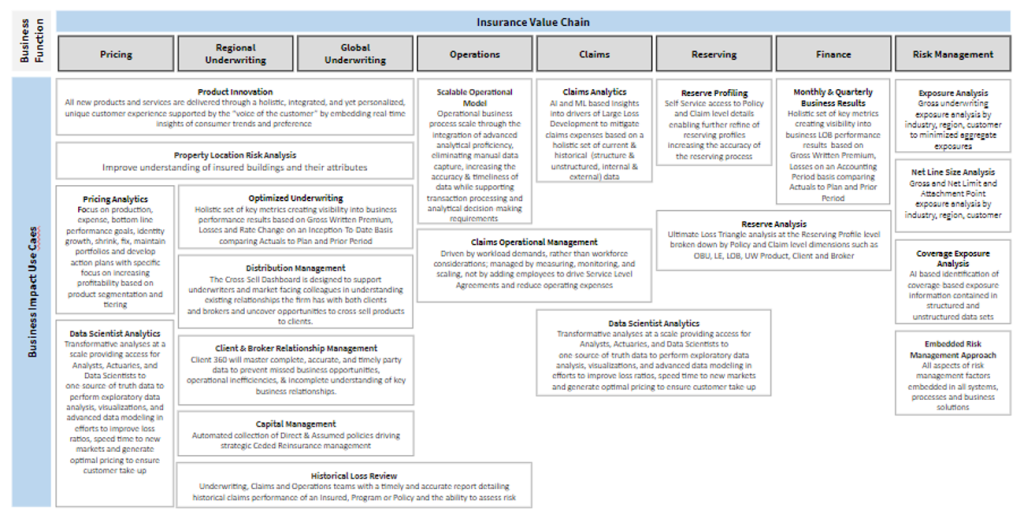

According to Dr. Karna, the whole risk management industry will benefit by optimizing its operating model and collaboratively working to make the global economy more resilient. This idea forms the basis of her strategy to build a standard across industries on analytics proficiency. She believes broadening the approach from policy wordings to analytical maturity and data-driven risk management, leveraging the broader insurance value chain will be game changing.

“My mission is to leverage AI, LLMs, and other tablestake technology to create analytics at scale across the value chain within organizations, creating a momentum – a chain reaction – to allow our industries to reduce the growing global protection gap,” says Dr. Karna. “Most companies work with me to adopt a digitally enabled, customer-centric approach, transitioning their strategy to go from loss financing to risk prevention.”

So, what is Analytics @ Scale?

Leveraging foundational capabilities like AI, ML, LLM, NLP, and the like as an accelerator to processes and discovering insights. Collecting data, internal and external, that meet quantitative and qualitative standards and drawing out meaningful insights is the gist of Analytics @ Scale. Building out the talent and mindset to thrive in the era of 10x change.

It requires understanding data’s strategic and disruptive implications and harnessing its power to translate the information into tangible profitability. Analytics @ Scale gives a company an explicit comprehension of customer trends, enabling it to build a strategy with the customer at its core.

Equipped with the correct information, the company can improvise upselling and cross-selling, building an optimized portfolio with profitable growth. This information also increases the potency of predictive prevention, which drives informative consultancy, making identifying risks and prompt coverage easier.

Companies have the right base plate to develop plans to reduce the protection gap once risks are studied. Not just this, strategies are made preemptively, and customers are properly educated about them.

Analytics @ Scale has to be kneaded with the insurance value chain, transforming a company’s workflow to get the desired results. The following infographic explains how Dr. Karna’s concept is expected to remodel the value chain process.

Incorporating this idea technically and culturally within a company will create a drive to build affordable, simple, and comprehensive risk mitigation and recovery solutions. Dr. Karna is dedicated to fostering global resilience by harnessing the transformative potential of digital data technologies, ensuring our ability to navigate unprecedented threats effectively.